This article is sponsored by Specialty Healthcare Advisers, a MCRA Company.

The business of spine has become very tricky business. "For hospital CEOs back in 1990s through mid-2000s, the business of spine and rehabilitation services was much simpler," says Barry Zeman, former hospital CEO and Head of C-Level consulting services for Specialty Healthcare Advisers, the hospital and surgeon consulting division of Musculoskeletal Clinical Regulatory Advisers, LLC (MCRA). "Back then, when a highly qualified spine surgeon on our staff wanted to do a procedure we'd simply say great, go ahead, and thank you for performing your spine procedures here…"

Just a few short years later, with significant federal legal action on the horizon, the proposed 2-Midnight rule, significantly increased reimbursement denials of payment to providers due to pre- and post-payment Medicare reviews, the burden of proof regarding medical necessity documentation for surgical spine procedures lay squarely on the hospitals and surgeons performing the procedures. To add to spine surgeons' and hospitals' anxiety, spinal fusion was added to the Medicare PEPPER list last year, the fall-out from which is likely to cause increased scrutiny for a much embattled, yet vitally necessary surgical procedure.

The biggest issue today, as compared to years past, is that when a hospital and surgeon bill Medicare for a given procedure, as long as the bill was coded accurately, it was paid. Today, we're not only seeing recovery audit contractors going back after previously paid claims, CMS has given their regional payers (MACs) greater pre-payment authority allowing for denial of payment after a procedure has been performed. According to Zeman, "With ICD-10 on the near term horizon and a much greater emphasis being placed on medical necessity documentation, the days of performing cases with less than adequate documentation are gone forever." Zeman adds, "The considered opinion of the surgeon backed up by recent scans, radiographs and clinical observations is no longer adequate for smooth payment."

"The issue is very clear. In today's more highly regulated and restrictive payment environment both the hospital and the surgeon need to ensure that all of the medical necessity documentation to support and justify the procedure is there, clearly written in the patient medical record, particularly when it comes to elective procedures like spinal fusion and joint replacements," says Zeman. "Unfortunately, execution of complete documentation as required by the payers is highly variable and often inadequate to prove necessity to their satisfaction." With both pre- and post-payment audits of spinal procedures on the rise, the need for flawlessly documented medical records has never been more important.

Spinal surgery procedures under intensified scrutiny- DRG 460-added to PEPPER

For years Medicare watchdogs have been concerned about the increasing prevalence of spinal fusion procedures amongst their beneficiaries. In March 2012, spinal fusion procedures were placed on the Medicare Program for Evaluating Payment Patterns Electronic Report target list, otherwise known as the PEPPER list. Procedures on this dubiously infamous list include hospital admissions which have the highest propensity for improper payments.

"What's unique about spinal fusion procedures being added to the PEPPER list is the nature of the scrutiny," says Carolyn Neumann, Sr. Manger Coding and Coverage Access for Specialty Healthcare Advisers, Manchester Conn. "Unlike most other admissions on the PEPPER target list where hospitals are being asked to police themselves for outlier status, with spinal fusion, it's the quality of the medical necessity documentation for the procedure itself that's under scrutiny. With inpatient implantable cardiovascular procedures like balloon angioplasty or medical stent implants, in most cases, you have clear medical necessity based on visually apparent imaging that shows the blockage. With spinal fusion procedures there is a much greater level of subjectivity. This is why Medicare has become very clear with their requirements for documenting medical necessity prior to the procedure."

Similar to knee and hip replacement procedures, patients scheduled for elective spinal fusion procedures must have well-documented attempts at various other forms of conservative care, precise capture of imaging that clearly shows the source of the pain along with an accurate diagnoses.

"Spinal procedure coding, billing and medical necessity documentation is very complex business," says Neumann. She sees errors and a great deal of confusion based on phone call inquires received on the MCRA coding and reimbursement "hotline" service phone lines. In spine, not only must you do a phenomenal job of documenting the conservative approaches used prior to the surgery, you must also get the diagnosis correct, then accurately code and bill for exactly what went on during the procedure and then sufficiently recapture everything in a discharge summary.

When SHA performs a Spinal Fusion-Medical Necessity and Coding Analysis they expect documentation in the patients' medical charts to reflect the appropriate diagnosis and include much of the following:

- Pre-procedure radiologic findings or mention of the radiology report result in the medical record

o Failed conservative measures/treatment prior to surgery

o Documentation of duration of pain and/or impairment of function

o Physical exam documenting the functional pathology

o Documentation of instability if applicable

Medicare MACs and RACs finding high error rates with spinal fusion DRG-460

In April 2013, the Medicare MAC payer Novitas published the results of a service-wide post pay probe review for DRG 460 (spinal fusion except cervical without major complication/comorbidity). As stated on their website, the average dollar error rate for their Jurisdiction 12 was 73 percent, with denial rates ranging from 50 percent to 90 percent. A similar review of spinal fusion DRG 460 by Cahaba GBA (another MAC payer), completed in October 2012 demonstrated an overall claim error rate of 64 percent with 88 percent of the denials resulting from the lack of documentation of the appropriate indications for the spinal fusion.

This past October 2013, an update from Palmetto GBA, another MAC who has been administering Medicare health insurance claims for CMS since the Mid-90s revealed the results of their pre-payment service specific probe review of DRG 460 in North Carolina, Virginia and West Virginia. Palmetto's findings exposed extensively high error rates regarding lack of medical necessity documentation creating cause for significant concern nationwide.

According to data published on the Palmetto GBA website, a pre-payment review of 137 claims in North Carolina led to 90 of the claims either completely or partially denied. The total dollars reviewed was $3,436,774.63 and $2,246,323.73 was denied, resulting in a charge denial rate of 65 percent.

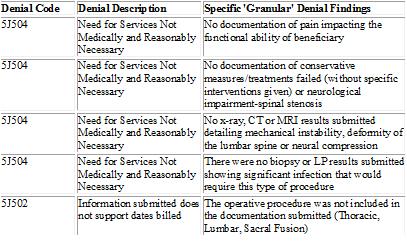

In Virginia and West Virginia combined, a total of 114 claims were reviewed, with 78 claims either completely or partially denied. The total dollars reviewed was $2,920,116.48, out of which $1,895,448.24 was denied, for a charge denial rate of 65 percent. In the vast majority of these spinal fusion cases, denial code 5J504 was used with a denial description of "Need for services not medically and reasonably necessary." More specific "granular" denial findings can be viewed in the chart below:

"These are rather significant denial rates that both hospitals and surgeons can ill-afford especially considering the fact that these procedures have already been performed," say Zeman. "With post-surgical payment denials like this, it is absolutely imperative that the history, diagnostic and procedural information along with the discharge status of the patient as coded and reported by the hospital, match both the attending physician description and the information contained in the patient's medical record."

Often, the documentation from the doctor's office and the hospital record is not in sync, says Neumann, whose firm also provides specialized orthopedic and spine coding analysis and reimbursement "hotline" services. "This is why we're so vigilant in performing analysis for hospitals and spine surgeons, particularly from a training and educational standpoint."

Neumann added, "Quite frankly, there is often a process communication breakdown between surgeon, (employed or voluntary) , and the hospitals where these cases are performed. When we perform a medical necessity documentation and coding analysis, we use the results to help train and in many cases, re-train surgeons along with everyone else involved so the potential of medical necessity documentation errors are reduced significantly. That's why constant education and internal audits on surgical charts are so important as they help to identify if your hospital or surgical practice has a problem."

Unlike commercial payers who most often require upfront data prior to a spine or joint replacement procedure (prior authorization or pre-approval), Medicare and their payment contractors are not set up this way. "In the past with Medicare, as long as you billed and coded for the procedure and met the stated criteria on the surface, the payment was usually paid to both the facility and the surgeon performing the case," says Neumann.

Today, with greater pre-payment review authority being given to MACs it's creating a whole new ball game. Under a pre-payment review, MACs have greater authority to examine the medical necessity documentation prior to making payment. There is an important difference with this type of pre-payment review compared to a post procedure recovery audit probe. In the case of the CMS pre-payment review, the case has already been performed and can be denied based on a lack of medical necessity documentation. This is very risky business for both hospitals and spine surgeons because if denied on a pre-payment review, reimbursement is at risk for a procedure already performed.

In their October 18, 2013 announcements, CMS issued Transmittal 489, providing MACs with instructions and guidance on 100 percent prepayment and random reviews. The guidance, effective November 19, 2013, provides MACs with additional authority to conduct prepayment reviews. CMS stated that they considered 100 percent prepayment reviews "appropriate" only upon finding that "a provider has a prolonged time period of non-compliance with CMS polices" while notably leaving a "prolonged time period of non-compliance" undefined.

CMS stated that any MAC seeking to conduct a 100 percent prepayment review must inform the CMS contracting officer's representation, regional office technical monitor, and the business function lead in advance. "The crux of the issue here is that in many of these probes, the MACs are requiring that the physician office documentation appear in the hospital chart or the hospitals and the surgeon would not be reimbursed for services," says Zeman.

"In 2013 we had been seeing an increase in recovery audit contractors' requests for medical records to validate medical necessity," says Zeman. According to the recent American Hospital Association survey of more than 12,000 hospitals, in the second quarter of 2013 alone, complex audit denials by RACs rose 58 percent, with two-thirds of hospitals reporting the most expensive RAC requests are medical necessity denials. Of the medical necessity denials reported in the survey, 62 percent were not because the care itself was unnecessary, but because of one-day stays in the wrong place."Of course the big difference between these RAC audits and MAC pre-payment review is the flow of the money.

At least with a RAC audit, you've already been paid and you can appeal the recoupment demands. With a pre-payment denial, you've already done the case and you may never get paid," says Zeman. With both types of reviews the most common reason for denials is the lack of medical necessity documentation.

"These medical necessity documentation errors are often avoidable and can be alleviated with improved process flow and communications between the hospital and the surgeon. This is why our analyses have proven to be so valuable. We take a sample of cases, review the entire chart for its medical necessity documentation completeness and then report the results back to the hospital or the practice. Obviously it's more helpful to find errors in an internal proactive self-audit where results can be used for training and education rather than after the procedure when payment is at jeopardy of being denied," says Zeman.

Jurisprudence in the spine market arena

This past July, the Justice Department prosecuted 55 hospitals in 21 states, recovering $34 million in settlements for spinal kyphoplasty procedures that were inappropriately billed to Medicare as in-patient procedures. According to CMS, this procedure can be performed safely and effectively as an outpatient without any need for a more costly hospitalization. The Justice Department maintained that the hospitals performed these procedures on an inpatient basis in order to increase their Medicare billings.

In total, more than 100 hospitals have now paid approximately $75 million to resolve allegations that they mischarged Medicare for kyphoplasty procedures. The government previously had settled with Medtronic Spine, the corporate successor to Kyphon. Medtronic, who purchased Kyphon in July 2007 for $3.9 billion paid a separate $75 million to settle allegations that the company defrauded Medicare by counseling hospital providers to perform kyphoplasty as an inpatient procedure, as the minimally-invasive procedure should have been done on an outpatient basis.

"By keeping patients overnight, without regard to medical necessity, hospitals could seek greater reimbursement from Medicare and make much larger profits on kyphoplasty," said Kathy Mehltretter, U.S. Attorney for the Western District of New York in Buffalo where one of the cases had originally been filed.

Back in October 2013, The Washington Post published an article lambasting spinal fusion procedures. In their hotly contested article, authors Whoriskey and Keating reveal how the Justice department is prosecuting a landmark case in what could turn out to be the largest Stark Law violation in U.S. history. There, a reputable spine surgeon at Halifax Hospital is accused of performing spinal fusion procedures that were not medically necessary. In addition, the DOJ who joined the case in 2011 is contending that the hospital improperly incentivized their physicians. In total, the DOJ is seeking $750 million to $1 billion for 74,838 claims made between 2000 and at least 2010, totaling up to $823.2 million in penalties.

The Post article said that the Halifax case will serve as a case study on the many financial incentives that come into play when a surgeon is deciding whether or not to operate. Almost all of them push in the direction of operating, even when more conservative treatment is now deemed to be in the patient's best interest, reported the Post article. Attempts by insurers and Medicare to curb excessive surgeries have been squelched by negative publicity and heavy lobbying by the American Medical Association and the medicaldevice industry reports the Post, although increasingly higher levels of scrutiny have abounded in recent years.

In response to the Washington Post article, the North American Spine Society Executive Committee fired back with a press release response on 10/30/13 stating that "fusion of the spine is an invaluable tool in a surgeon's armamentarium to alleviate intractable pain and return patients to healthy, productive lives. As in all surgical procedures, the key is the surgical indication for the individual patient. Underuse and overuse are both bad medicine and do the patient a disservice."

The release further stated, "NASS is collaborating with Medicare and private insurers carriers to develop evidence based guidelines for surgical intervention and to define conditions that are best treated without surgery. Spinal fusion is currently undergoing rigorous scrutiny; the indications for spinal fusion are being evaluated and re-evaluated constantly in an effort to develop optimal indications to serve the best interest of the patient."

"As a former hospital CEO, I concur with the opinion of the North American Spine Society that for millions of people suffering from intractable back pain, spinal fusion procedures are an incredibly important option to relieve suffering," says Zeman. "Based on our experience of our staff, in most cases the procedure is certainly indicated and medical necessity documentation, the proof as to why the procedure was performed, is there. However, either busy surgeons don't pay as much attention to the details of adequate documentation, or they have a real lack of understanding of what is required. Either way, the need for improved documentation exists. In the absence of significant improvements in the capture of all pertinent documentation, a high percentage of pre-payment denials and post procedure recovery audits will continue to prevail."

Inside the spine numbers

The number of spinal procedures in the United States has somewhat flat-lined in recent years, yet there are still more spine surgeries performed in the U.S. than in any other country in the world. According to data recently released in the October 2013 Spinal Surgery Update published by the Orthopedic Network News, in-patient spine procedures likely eclipsed 791,000 in 2013 (up 4 percent over 760,000 cases in 2012) excluding roughly 500,000 (less invasive) outpatient decompression procedures.

According to their figures, the U.S. spine industry is estimated to have grown only 2 percent between 2012 and 2013 with an estimated $6.8 billion in spine related revenue generated for U.S. hospitals in 2013. While the overall spine market has basically remained the same since 2010, it's up almost 30-fold since 1994, when Orthopedic Research Network first estimated the U.S. market to be $225 million.

The 2013 Spinal Surgery Update also revealed the fact that fusing the lumbar vertebrae remains the preferred approach using a combination of pedicle screws and interbody fusion devices which accounted for 49 percent of the lumbar fusions in 2013. The update indicated that the overall average cost of a lumbar fusion was $12,968 (up just $49 dollars from 2012) although the costs will vary, based on the number of levels being fused. Listed below are the average costs for 2013:

- Single level lumbar fusion in 2013 was $9,843

- Two-level lumbar fusion was at $12,893

- Three-level lumbar fusion was $15,840

- Three-plus level lumbar fusion was $18,333

Of the roughly 791,000 spine inpatient procedures reported in 2013 Spinal Surgery Update, 50 percent were identified as lumbar or thoracolumbar fusions, 37 percent were cervical fusions, and 7 percent were vertebral compression fracture repair. The remaining 6 percent of cases were disc replacements, and interspinous process inserts.

According to the update, the majority of patients undergoing lumbar fusions procedures are females having increased from 54 percent in 2012 to 58 percent in 2013, while the number of Medicare beneficiaries is on the rise. The update revealed that in 2008 only 30 percent of spine cases were of Medicare age (over 64) and now, based on their 2013 update, 43 percent of spine surgeries are being paid for by Uncle Sam.

"In today's more health conscious society there's often not much difference between a healthy 72-year-old compared to someone in their mid-60s. Consequently, you will see more and more spinal procedures performed on Medicare beneficiaries," says Zeman. This is evidently why spinal fusion procedures have received so much recent attention from CMS in recent years. Not only have the amounts of Medicare beneficiaries receiving spinal fusion procedures increased, the costs of these (often elective procedures) are among the highest around.

Transparent spine reimbursement numbers

For the first time this past May, in a bold act of relatively unprecedented transparency, CMS revealed their highly controversial inpatient dataset report, listing hospital specific charges and payments for the top 100 most frequently performed procedures based on Diagnostic Related Groups.The data was for 3,400 hospitals and represented 92 percent of all hospital inpatient charges for 2011.

Of no surprise, spinal fusion procedure DRG 460 was among the top 100 procedures. As expected, the charges levied by hospitals varied significantly. "Like most charges issued by doctors and hospitals, the amounts billed are quite different from whatactually gets paid. Although there are reasons for higher payments based on extenuating factors like residency program status, rural outlier standing and disproportionate share of indigent patients. Still,it was quite surprising to see such drastic disparity in the actual payment amounts listed in the dataset," says Neuman.

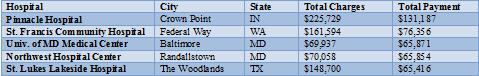

Of the top 1,133 hospitals who performed the most spinal fusion (DRG-460) procedures (list excluded any hospital performing less than 10 spinal fusions per year) the amounts billed to Medicare ranged from a high of $417,121 to a low of $19,186 with an average billed amount of $95,568. With regards to actual payments made to hospitals there was a tighter, yet still awkwardly ranging scale from a high payment of $131,187 to a low of $16,772 for a spinal fusion procedures.

"When you look at what hospitals were actually paid you are forced to wonder, extenuating circumstances aside, how is it that one hospital could receive say $30,000 while a very similar hospital nearby collected $50,000 for the exact same procedure?," added Ms. Neumann.

Health and Human Services Department Secretary Kathleen Sebelius terms "a key piece of the [healthcare] cost puzzle," is the latest federal effort to "bring more transparency" to the healthcare market as well as "empower consumers, create competition, and help hold down costs. When consumers can easily compare the price of goods and services, producers have strong incentives to keep those prices low. That's how markets work," stated Sebelius according to Media Health Leaders article published in May 2013.

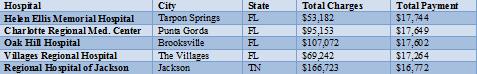

For patients looking inside the spinal fusion amounts paid to hospitals, they may become a bit confused with how and why there are such huge variations. Below is a list of the highest and lowest paid hospitals based on the actual amount of total payment received along with the charges levied by the hospital:

Medicare MS-DRG IPPS Charges & Payment Summary 2011

MS-DRG 460 Lumbar Spinal Fusion - Highest Medicare Payments, 2011

MS-DRG 460 Lumbar Spinal Fusion - Lowest Medicare Payments, 2011

The movement toward minimally invasive spine procedures & impact of ACOs

Two of the more significant healthcare trends that will certainly impact the future of inpatient spine procedures are the ever-pressing movement towards performing less invasive spine procedures in the outpatient or ambulatory surgery center setting and the downward pressure on elective spine procedures caused by evolving accountable care organizations.

Not only will spinal fusion remain under the proverbial microscope from a pre-payment, recovery audit and restrictive reimbursement standpoint, there is also a clear and ever pressing movement towards performing what had long been considered inpatient only spine cases in the outpatient ASC setting. There are several major healthcare motivators that will continue to advance the migration of inpatient spine procedures over to the ASC setting, explains Mr. Zeman.

"First, the costs are much less for many spine procedures performed in the outpatient setting as compared to an inpatient overnight stay of up to three days. In addition, there is significantly less blood loss, less risk of infection, less disruption of surrounding musculature and quicker healing time. The movement toward minimally invasive spine surgery has been somewhat slower than the many who had predicted we would see upwards of 50 percent of spine surgeries being performed in outpatient ASC settings," says Zeman.

However, there are multiple reasons why the movement to outpatient will continue, including a more cost-conscious society who are incurring much higher co-pays for elective procedures along with arguably better results in more comfortable surroundings.

In order for the movement to take on significant momentum, Medicare will have to recognize the ambulatory surgery center setting as a viable and reimbursable site of service. Currently, most spine procedures are considered inpatient-only by Medicare and CMS only covers certain spineproceduresperformed in the hospital outpatient surgical setting. At this time, freestanding ASCs are not approved to receive reimbursement for these same procedures.

"If and when Medicare does cover minimally invasive spine procedures in free standing ASC settings, we can expect a big shift in this business. Another meaningful shift may occur as new technologies now available or in the pipeline for treatment of spinal conditions are more commonly performed in ASCs," added Mr. Zeman.

ACOs are evolving organizations characterized by a payment and care delivery model that seeks to tie provider reimbursements to quality metrics and reductions in the total cost of care for an assigned population of patients. With the overall goal of most ACOs to reduce unnecessary hospital admissions and avoidable readmissions, elective spine surgeries are likely to experience additional approval difficulties from these entities as they grow.

"The statistics are pretty high with respect to repeat back surgeries, including revisions, and you can bet that as ACOs continue to advance, pressure to reduce hospital admissions will have its impact on elective inpatient spine surgeries, especially if ambulatory alternatives exist," says Zeman.

Spinal procedure medical necessity documentation, scrutiny here to stay

With the heightened scrutiny caused by the spinal fusion PEPPER addition, the DOJ litigation of the kyphoplasty cases and the spinal fusion landmark case in Florida it appears likely that concentrated examination of the spine market consisting of pre- and post-payment reviews are here to stay. Adding to the fever pitch scrutiny are the proposed changes of 2-Midnight regulations, the game changing ICD-10 implementation along with the continued increase in the number of ACOs and you have a significantly changed spinal surgery marketplace.

7 likelihoods for spine in the new year

- Based on the high percentages of medical necessity documentation errors found in previous pre-and post-payment reviews of spinal procedures, intensive probes of these procedures will likely continue and perhaps at a much more aggressive pace in 2014.

- The movement toward minimally invasive spine procedures being performed in the ambulatory surgery center setting will continue to gain momentum.

- As ACOs evolve, more restrictive policies and reimbursement methodologies will be imposed, strongly incentivizing outpatient procedures over inpatient hospitalizations with overnight stays.

- Elective spine procedures will begin to more closely emulate step-care drug formularies where the uses of less costly alternatives are mandated.

- Bundled payments for outpatient procedures, though not as relevant for spine currently, as with other orthopedic procedures are likely to rise as spine cases move towards outpatient setting.

- Increased pressure from consumers causing greater levels of transparent pricing will lead to tougher conversations with respect to out-of-pocket costs for elective spine procedures.

- Hospitals and surgeons will become more vigilant with ensuring that preventable mistakes regarding medical necessity documentation are avoided.

More Articles on Spine Surgeons:

Minimally Invasive Spine Surgery: Advantages, Economic Impact & Transitioning to Outpatient ASCs

14 Recent Spine & Neurosurgeon Achievements

Where the Spine Device Field is Headed: Q&A With Invibio's Michael Veldman